Description

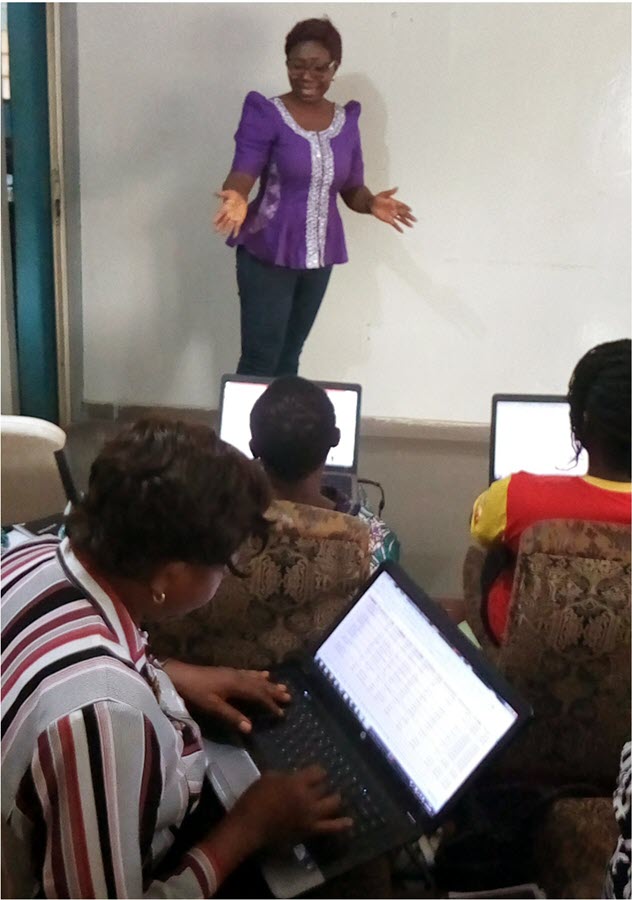

SPECIALIZED TRAINING

Introduction

As one of the services we render at Muyesther Global Consult, we take your accounting staff through a series of training – tailored toward enhancing their on-the-job performance.

Over the years, we have discovered that the accounting profession is one of the few professions with very high rate of advancement, which makes training and re-training a necessity. This is to keep the staff abreast of relevant/current information pertaining to the profession, and their jobs.

From our experience, we have identified three (3) key areas where accounting professionals are expected to display high level of proficiency, deficiency in which will have direct or indirect effects on their employers. These key areas are; Financial Accounting, Tax Management and Use of Accounting Packages.

In view of this, we introduced the following courses as solutions to these critical issues:

a. Practical Financial Accounting and Ethics;

b. Practical Tax Management and

c. Development and Practical Use of Accounting Packages.

A. Practical Financial Accounting and Ethics

A very key function of the Account Department is financial accounting. As much as there are basic aspects of this that could be handled by an average accountant, there are other aspects that require practical training and experience. Some of this areas included in the proposed training are as follows:

i. Management of supporting documents;

ii. Payroll management;

iii. Inventory management;

iv. Assets management;

v. Account reconciliation;

vi. Preparation for External Auditors and Tax Auditors;

vii. Account Preparation and

viii. Setting up of accounting system.

B. Practical Tax Management

In most organizations, the account department is not separated from the tax department, which invariably implies that tax management becomes an implied responsibility of the account department. Meanwhile, tax management requires a lot of technicalities and professionalism, which is often lacking in accounting departments of many organizations. Hence, tax avoidance, which is a legal way of capitalizing on loopholes in tax laws, with an aim of reducing tax liabilities, is not enjoyed by such organizations.

The specialized training is aimed at equipping accounting staff with relevant information, which shall enable them do their jobs with the consciousness of avoidance or reduction of the tax liabilities and penalties of their employers. This has been packaged under the following outlines:

i. Practical tax deduction – PAYE, VAT, WHT et cetera;

ii. Practical tax remittance – PAYE, VAT, WHT et cetera;

iii. Practical tax filing with State Internal Revenue Service – filing forms, e-tickets, submission;

iv. Practical tax filing with Federal Inland Revenue Service (FIRS) – e-registration, e-filing and

v. Penalties and interest on non/late filing – PAYE, VAT, WHT et cetera;

C. Development and Practical Use of Accounting Packages/Reporting

Accounting profession has advanced so much in recent times that the use of manual accounting system is gradually giving way to electronic accounting system, which includes the use of accounting packages such as Sage 50, Peachtree, QuickBooks et cetera.

However, we have observed that these accounting packages cannot be adequately maximized without relevant practical skills in the use of such packages and Microsoft Excel. In order to ameliorate this, we have designed this training to capture these sensitive areas to enhance the productivity of the accounting staff:

i. Introduction to accounting packages;

ii. Principle of practical accounting data update;

iii. Practical generation of financial reports from accounting packages;

iv. Table/Graphic reporting in excel;

v. Use of audit trail;

vi. Advance Excel – use of pivot table, lookup, vlookup and macros and

vii. Practical electronic security.

Your responsibility

It is the responsibility of the client to mobilize the staff for the training at such a time that is most suitable for them. This is expected to be communicated to us not later than two weeks to the commencement of the training.

More so, training period is also a period of refreshment for the staff. Hence, it is your responsibility to provide refreshment, except there is an agreement that this should be taken care of by our firm.

Our responsibilities

Our responsibilities shall include;

i. Provision of training personnel;

ii. Provision of training materials – training manual;

iii. Logistics for all the instructors and training support for staff

iv. Provision of certificate of participation to each of the participants.

Cost of Service

The project shall attract training cost, which shall depend on subsequent meeting during which time we would have been informed about the proposed number of staff to be presented for training and the actual number of days proposed for the training.

Training Duration

Duration for the training exercise is largely dependent on the number of training batches and the number of courses agreed to be taken. However, we expect that the training is concluded for all staff within a maximum period of two weeks.

Should you require further information, kindly Contact Us.

Thanks.

Reviews

There are no reviews yet.