PRACTICAL LABORATORY FOR ACCOUNTANTS/CONSULTANTS FOR SECOND HALF YEAR OF 2022

Dear PC,

Dear PC,

The first half of every year is a busy period for accountants, especially those whose accounting year end is 31 December. Such time is usually devoted to account preparation, annual audit and filing of tax returns. In fact, it is unlikely an accountant is able to secure annual leave during that time due to several necessary official engagements. This continues to 30 June when the accounts are files with Federal Inland Revenue Service (FIRS) to safeguard the employers from avoidable tax penalties.

However, the second half of the year is less busy, both accountant working for their employers and those practicing as consultants. This is why many would not have opportunity to apply for their annual leaves until the second half year.

After serving your employers and clients during the first half of the year, don’t you consider developing yourself at this second half?

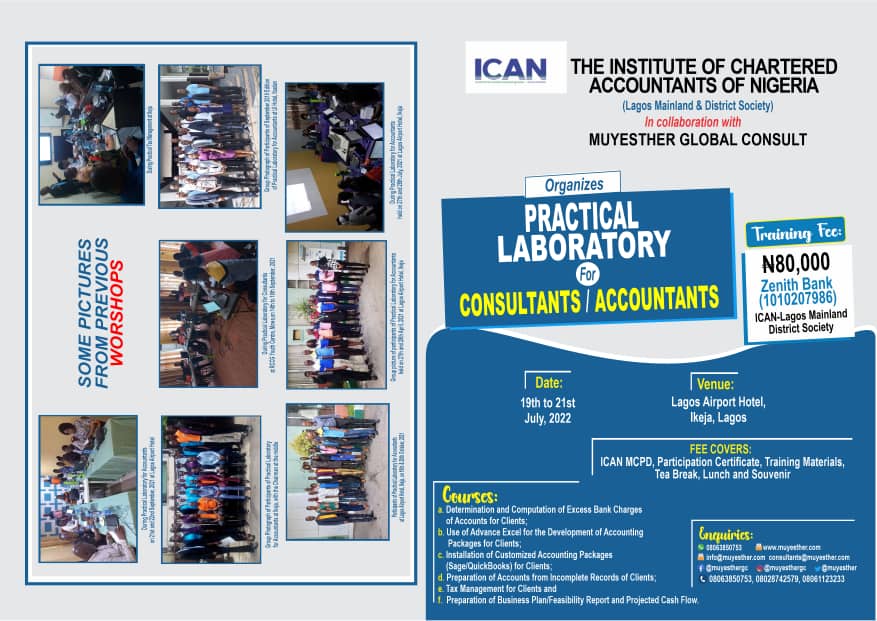

At Muyesther Global Consult, we have designed workshops tagged Practical Laboratory for Accountants (for employed accountants) and Practical Laboratory for Consultants ( for those in practice). The workshops are meant to either make you consistently relevant to your employers ( if you are employed) of enhance your consultancy deliverables (if you are in practice)

Available Courses for Practical Laboratory for Accountants include:

- Practical Financial Accounting – dealing with use of supporting documents, preparation of management accounts et cetera;

- Practical Tax Management – dealing with deduction, remittances and filling and various forms of taxes including VAT and Withholding Taxes;

- Practical Use of Accounting Packages – dealing with posting of transactions into customised accounting packages (Sage and QuickBooks), all kinds of reconciliations and generation of management reports;

- Practical Use of Advanced Excel – dealing with the use of Microsoft Excel functions for data analysis, data classification and reporting.

Available Courses for Practical Laboratory for Consultants include:

- Practical Skill for Account Preparation for Clients in Practice – dealing with preparation of accounts from incomplete records;

- Management of Tax Issues of Clients in Practice;

- Installation of Customised Accounting Packages for Clients in Practice;

- Use of Advanced Excel for the Development of Accounting Packages for Clients;

- Practical Computation of Excess Bank Charges for Clients and

- Preparation of Feasibility Report/Business Plan and Projected Cash Flow for Clients.

Types of Workshop

- General Class – where participants are welcome from different organisations;

- Intensive Class – for an individual or a maximum of three participants who have interest in a particular course, and who need to gain more attention of the instructors;

- Specialised Class – for organisations who want to either send their staff of invite us for an in-house workshop and specialised area of the profession;

- Catch-Them-Young – for undergraduates who want to get exposed to the practical aspect of our profession, which will aid an understanding of the theoretical studies.